Wealth Management Begins with Risk Management

At Schadler Financial our focus, first and foremost, is on managing risk. Why? Because the “buy and hold” strategies that worked in the past have proven inadequate to 21st Century challenges:

- From 2000-02 the S&P declined 47%; the NASDAQ declined 78%.

- From 2007-09 the S&P declined 56%.

The Fallout: A Lost Decade and More….

For a buy and hold investor it took almost 13 years, from March 2000-January 2013, just to recover what they had lost in these downturns. They made nothing and would have seriously depleted their nest egg had they taken money out for retirement or emergencies.

Click Image to Enlarge

Can You Afford to Proceed with Business as Usual?

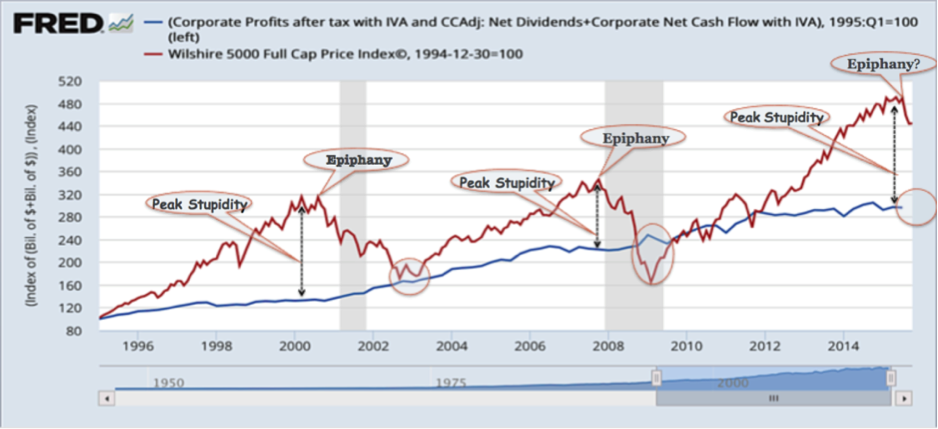

Since bottoming out in March 2009, the S&P has gone on a 7-year bull market run that has more than tripled its value. It traded near its all-time high at a time when corporate profits declined 18% from their peak levels.

Additionally, two major sources boosted its climb:

- The Fed’s quantitative easing

- Corporate stock buybacks

When there is an occasion when a client needs go beyond the scope of our firm we have developed relationships with legal & accounting firms along with other companies that may help to solve a client’s special situation.

Our Answer: Low Risk, Low Volatility Investment Platforms

To answer these concerns, Schadler Financial has affiliated with a registered investment advisor (RIA) founded by multi-decade veteran advisor Drew Horter. Since the Great Recession of 2007, the RIA’s assets under management have grown from $50 million to over $1 billion.

The reason for this dramatic growth in the wake of the 2007-09 melt down was that Drew was able to assemble a select group of private wealth managers, all of whom had protected their clients from catastrophic losses during these times while capturing robust gains when market conditions were favorable. (1)

The Key Ingredient: Tactical Management

Clearly they didn’t achieve such results with a buy and hold or asset allocation strategy. Instead, they all relied on their proprietary, tactically managed trading platforms to help guide their investment decisions: when to be in the market, when to go “risk off” to cash, and even when to hedge and possibly make money when markets were declining.

The Lost Decade Revisited: How We Measure Up

The RIA we work with has a track record to show you how their managers performed- in both stock and bond funds- over full market cycles, and how much better the results can be with proven, tactical management.(1)

Did you share in any part of that “lost decade” we outlined above? Would you like to compare the results of the portfolio managers of the RIA we work with to your own? We invite you to do so. Even if you’ve been working with a trusted advisor, isn’t it prudent to get a second opinion? In these times and these markets, can you afford not to?

Creative Solutions

Our goal for each client is to bring all our recourses to bear in an effort to give time-tested solutions for today and beyond.

Professional Team

Our affiliates span the financial landscape. We want to always use client first solutions no matter where we need to turn.

Diverse Approach

We don’t believe in the sales culture, but instead we believe in the service culture. Our approach is to dig in and get to the core issues.

Complimentary Investment Risk Analysis

We invite you to have a complimentary risk analysis done by us, where we can show you in detail the kind of risks you currently have in your portfolio and how it compares to strategies we offer.

Find Your Own Investment Risk Tolerance

To find out how much risk is in your current investment portfolio, please click here to email us or phone 949.485.2598. To sign up for a free consultation or to just get more information click here.